Taxation

Mauritius, a low-tax Jurisdiction

Remittance-based tax system.

15% flat tax for corporations and individuals.

0-3% effective tax for some legal entities.

0-10% solidarity levy for tax resident individuals.

No capital gains tax.

No inheritance tax, no gift tax.

No withholding tax on dividends.

Taxation in Mauritius

The following information provides an overview over the most important tax considerations of founding a legal entity in Mauritius and relocating physically to the island, respectively. (All data without obligation.)

Individual Taxation in Mauritius

- Citizen-based taxation

- Residence-based taxation

- Territorial taxation

- Remittance-based taxation (i.e., non-domiciled taxation system)

- No direct taxation

Mauritius has a remittance-based taxation system which is very beneficial for individuals who are tax resident there. That means: The resident will be taxed only on earnings generated in or from Mauritius, or money brought into Mauritius.

The income tax rate on individuals is a flat rate of 15%.

Effective from 01 July 2020, a tax resident individual will be subject to Solidarity levy at the rate of 25% in excess of MUR3m of his leviable income. However, the levy is capped at 10% of the sum of:

- His net income excluding the lump sum (by way of pension, death gratuity or compensation for death or injury); and

- Dividends including share of profits from societe or succession.

An individual becomes tax resident if he has his domicile in Mauritius unless his permanent place of abode is outside Mauritius, or has been present in Mauritius for a period of 183 days or more in an income year (1 July – 30 June) or has been present in Mauritius for an aggregate period of 270 days in an income year and the 2 preceding income years.

Employment-related taxes: There is a Pay As You Earn (PAYE) system in place. Tax on employment income is withheld monthly by the employer and remitted directly to the Mauritius Revenue Authority (MRA). Income not subject to PAYE is self-assessed.

The pension system under the National Pension Fund is being abolished and replaced by Contribution Sociale Généralisée (“CSG”) as from 01 September 2020:

- For people earning up to MUR 50,000 per month, the contribution is 1.5% for employees and 3% for their employers.

- For those earning more than MUR 50,000 per month, the contribution is 3% for employees and 6% for their employers.

- A self-employed is required to pay CSG as follows:

- Net Income for the month not exceeding MUR 10,000: MUR 150

- Net Income for the month MUR 10,000 – 50,000: 1.5% of 90% of the net income for the month; minimum payable – MUR 150

- Net Income for the month exceeding MUR 50,000: 3% of 90% of the net income for the month

- A Self-employed individual may opt to compute his net income with respect to a month on the basis of one twelfth of the net income of the preceding financial year, provided the Self-employed has been operating during the corresponding 12 months.

Corporate Taxation in Mauritius

The corporate tax rate is 15%. Companies are taxable on their worldwide income. A company is resident in Mauritius if it is incorporated in Mauritius or has its central management and control in Mauritius. A company will not be considered as tax resident in Mauritius if it is centrally managed and controlled outside of Mauritius.

A partial exemption regime would be introduced whereby 80% of the specified income of Mauritian resident companies would be exempt from tax. The specified income for this purpose would apply to the following income streams:

- Foreign dividends

- Profits attributable to foreign permanent establishments

- Interest and royalties

- Income from specified financial services

- Interest income derived by a person from money lent through a Peer to Peer lending platform operated under a

licence issued by the FSC after the 5 year tax holiday - Income derived from the leasing and provision of international fibre capacity

- Income derived from reinsurance and reinsurance brokering activities

- Income derived from the sale, financing arrangement and asset management of aircraft and its spare parts, including aviation related advisory services

Where the company is licensed by the FSC, it will be required to comply with a set of pre-defined substantial activities requirement to be able to benefit from the partial exemption.

From 1 July 2022:

Manufacturing companies engaged in biotechnology, medical and pharmaceutical

sector:

- Subject to tax at the rate of 3% instead of 15%, provided the company satisfies

the prescribed substance requirements and has not claimed partial exemption; - Tax credit equal to 100% of capital expenditure for acquisition of patents.

Tax Holidays

- 8 year tax holiday – Innovation driven activities on income derived by a company

from intellectual property assets developed in Mauritius. - 8 year tax holiday for a company engaged in the development of a marina.

- 8 year tax holiday on income derived by companies engaged in the manufacture of nutraceutical

products. - 8 year tax holiday for an institution ranking among first 500 tertiary

institutions worldwide setting up branch campuses in Mauritius. - 5 year tax holiday to companies setting up an e-commerce platform in Mauritius before 30 June 2025 and is a holder of an E-commerce certificate issued by the Economic Development Board, subject to satisfying certain substance conditions.

- 10 year tax holiday for Family Offices.

For newly established companies registered with the Economic Development Board with an “Investment Certificate”, an 8-year tax exemption applies in the following industries:

- Aquaculture

- Industrial Fishing

- Seafood processing

- High Tech manufacturing

- Pharmaceutical research and manufacturing

- Agro Processing

- Food Processing

- Healthcare, Biotechnology and Life Sciences

- Nursing and residential care

- Digital technology and innovation

- Marina

- Tertiary Education

- Seeds Production

- Other activities as approved by the EDB

Losses can be offset against future corporate income in the following five income years. Losses may not be carried back.

Effective as from 1 July 2018, companies facing financial difficulty can carry forward unrelieved accumulated tax losses upon more than 50% change in the ownership of the company, subject to meeting the conditions as imposed by the Minister of Finance and Economic Development.

- Dividends: 0%

- Interest: 15% (This WHT applies to interest paid to any person, other than a company resident in Mauritius, by a person other than a bank)

- Royalties: 10% for royalties paid to residents (15% to non-residents). Not applicable to Global Business Companies if it pays the interest out of its foreign-source income.

- Rent for buildings: 5%

- Payment to contractors and subcontractors: 0.75%

- Payments to certain service providers: 3%

- Payments made to non-residents for services rendered in Mauritius

- Payment of management fees: 5% to residents, 10% to non-residents

Depreciation

Effective as from the Year of Assessment (“YOA”) commencing 01 July 2021:

Double deductions on the following items subject to no annual allowance claimed on such assets:

- Medical research and development carried out in Mauritius.

- Cost of acquisition of patents and franchises including associated costs to comply with international quality standards and norms.

- Double tax deduction on R&D qualifying expenditure (till June 2027).

- Acquisition of specialised software and systems;

- Expenditure incurred for research and development targeting African market. However, no annual allowance deduction can be claimed.

Accelerated tax depreciation available on assets acquired as follows:

- Electronic, high precision machinery or equipment and automated equipment: deduction of 100% in the year incurred (subject to no annual allowance claimed on such assets)

- 110% tax deduction to large manufacturers (annual turnover exceed MUR100 Million) on products purchased from local SMEs (turnover does not exceed MUR50 Million).

Investment Tax Credit

15% Investment Tax Credit (“ITC”) available on new plant and machinery to manufacturing companies over 3 years.

CSR is not applicable to any body corporate holding a Global Business licence issued under the Financial Services Act.

Controlled Foreign Companies

Mauritius introduces CFC rule becoming effective as from the year of assessment commencing 1 July 2020.

- CFC is a company which is not resident in Mauritius and in which more than 50% of its total participation rights are held directly and indirectly by a resident company in Mauritius or together with associated enterprises.

- CFC also includes a permanent establishment of the resident company.

- CFC rules are not applicable to a CFC where in an income year –

- accounting profits are less than EUR 750,000 and non-trading income is less than EUR 75,000;

- accounting profits are less than 10% of its operating costs of the tax period; or

- The tax rate in the country of residence of the CFC is more than 50% of the tax rate in Mauritius.

- The CFC rules applies where the Mauritius Revenue Authority (MRA) consider that the non-distributed income of the CFC arises from non-genuine arrangements designed for the purpose of obtaining tax benefits.

What does it mean?

First of all, the new CFC rules limit the tax advantages that were possible through well-structured international tax relations. However, SMEs can still have ownership in a CFC in a zero tax jurisdiction without the CFC’s corporate income to be taxed in Mauritius as long as the accounting profits are less than EUR 750,000 and non-trading income is less than EUR 75,000.

Exit Tax: When you leave your country

Kinds of exit tax:

Expatriation tax for US citizens terminating their citizenship

Exit tax for long-term residents—lawful permanent residents of the United States (holders of a “green card” visa)—who terminate that status after holding it for many years

Emigration tax for residents leaving specific high-tax jurisdictions:

-

- Germany: If the resident emigrates to a foreign country. Applicable for corporate entities only.

- Austria: If the resident emigrates to a foreign country; tax will be deferred until the asset is finally sold if the country of destination is within the EU/EEA. Applicable for corporate entities only.

- France: There are plans to alter the exit tax regime which was introduced in 2011. In its less restrictive version, the tax will be levied only if assets are sold within two years of a person’s leaving France. Assets up to 800,000 EUR are free of charge.

- Spain: The value increase of shares, collective investments or similar investments is taxed, when the market value of the shares held exceeds €4 million or the total shareholdings exceed 25% and the market value of the shares exceeds €1 million.

- The Netherlands: Exit tax for corporations or its assets leaving the country, starting in 2019.

- South Africa: A person who is resident or domiciled in South Africa and takes up permanent residence in a country outside of the Common Monetary Area (South Africa, Namibia, Swaziland, and Lesotho). Assets up to R4 million are free of charge.

- Special rules apply for each country regarding qualifying time of prior tax residency, tax exemption limits, regulations for re-entering the country within specific time periods, minimum ownership, provisions of the relevant DTAA, and others.

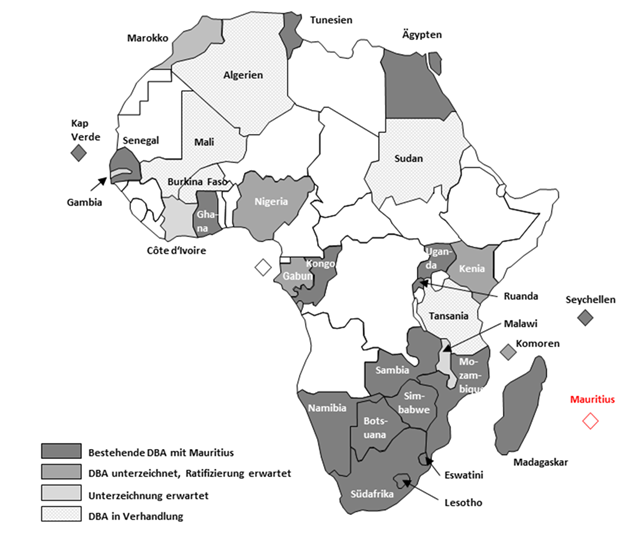

Double Taxation Avoidance Agreements (DTAAs) of Mauritius

Mauritius has signed DTAAs with 47 countries, thereof 18 in Africa. In addition, 7 tax treaties await ratification, 4 treaties await signature and 20 treaties are being negotiated.

Furthermore, there are 10 Tax Information Exchange Agreements (TIEAs) in force, and another 3 await signature.

The specific advantages for a Mauritius-registered entity benefiting from the DTAs are:

- Capital gains tax (CGT), where imposed in Africa, is generally levied at a rate ranging from 30-35%. However, the DTAs in force in Mauritius restricts taxing rights of capital gains to the country of residence of the seller of the assets. Since there are no CGT in Mauritius, the potential tax savings for the Mauritius registered entity are significant.

- The majority of African states impose some withholding tax on dividends paid out to nonresidents, varying between 10% and 20%. The DTAs in force in Mauritius limit withholding tax on dividends.

- With respect to CGT, the DTAs guarantee the maximum effective withholding tax rate should changes occur in the fiscal policy in the countries of investment.

Opinion

“Mauritius is one of the best jurisdictions in the world for global business and investments, as well as a beautiful, safe and healthy place for working, living and retiring!”

(emigrated from Germany to Mauritius in 2015)