Property & Real Estate

The paradise opens to the world

The real estate sector is particularly attractive due to the absence of any capital gains tax, estate or inheritance tax.

Owners of property can obtain permanent residency.

From 2020 to 2022, many rules have become more favourable.

Real Estate in Mauritius: The paradise opens to the world

Residential Property Schemes

Non-citizens and expatriates are eligible to make an acquisition for accommodation under approved schemes managed by the Economic Development Board of Mauritius. These residential properties include luxury condominiums, villas and apartments.

Condominiums in at least three-story buildings, on the other hand, can be purchased anywhere on the island if the purchase price is at least 6 million MUR (= approx. 130,000 EUR). This is the Ground Plus Two (G+2) program.

The Property Development Scheme (PDS) is a program to facilitate the development of and a purchase of residential luxury estate by non-citizens. The acquisition of a residential property in the schemes approved by the Economic Development Board, namely PDS entitles buyers and their dependents to a residence permit, provided that the property is acquired for a price exceeding USD 375,000.

The PDS has replaced the former schemes RES (Real Estate Scheme) and IRS (Integrated Resort Scheme; for luxury real estate with attending services and amenities) which are still valid for existing properties built under these schemes.

Luxury Villas

Town Houses

Apartments

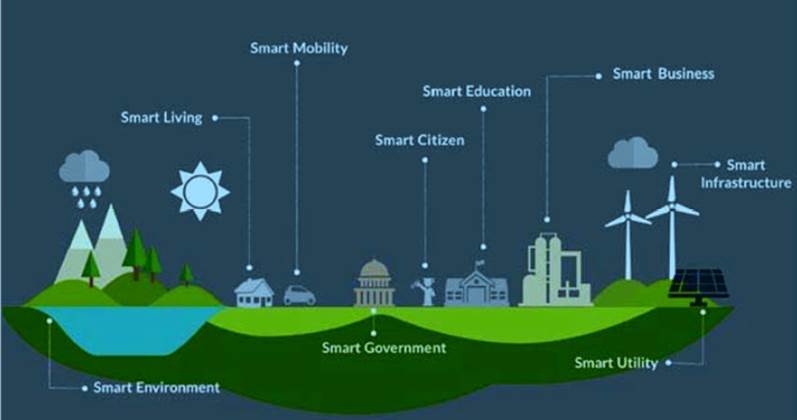

Smart Cities: The Future of Urban Planning

The Smart City Scheme is an ambitious economic development programme aimed at consolidating the Mauritian International Business and Financial Hub by creating ideal conditions for working, living and spurring investment through the development of smart cities across the island. These smart cities will leverage the latest advances in urban planning and digitalised technologies.

Holders of an Occupation Permit may acquire a building plot in a Smart City Scheme in order to build their own house on it.

Foreigners with an existing Residence Permit are allowed to buy property anywhere on the island!

An amendment to the law of August 2023 states that “residents” (as defined in section 8 of the Immigration Act) can buy residential property anywhere – i.e. also outside the PDS Schemes and Smart Cities – if the purchase price is at least USD 500,000 (in 2022, the lower sum of USD 350,000 had been provided for) and the purchase is approved by the competent authority. The maximum size of the developed or undeveloped plot is 5,050 square metres. Both freehold and leasehold are possible.

However, state land is exempt from this regulation. According to the Pas Géométriques Act, all land within a strip of at least 81 metres from the coastline (defined as the high tide line during spring tides) is State Land. Land located directly on the beach can therefore generally not be purchased or leased by foreigners.

Foreigners are charged an additional registration fee of 10% of the purchase price. However, this “special tax” probably pays off anyway, because the price discount of properties reserved for locals compared to those accessible to foreigners was quite 25-35% in the past.

In addition, each eligible person may only purchase one property from this programme. It is not possible to acquire the Residence Permit through the purchase of real estate.

Residence Permit for each buyer in case of joint purchase of a property

Each non-citizen who each invests more than USD 375,000 into a single residential property under ‘fractional ownership’ is entitled to apply for the status of residency.

Investment Opportunities in Commercial Property

The market for commercial and industrial properties is open to foreigners subject to meeting certain conditions and on approval by the Prime Minister’s Office.

Various business park / commercial park and industrial park projects welcome investors.

Business Parks

Office Buildings

Industrial Parks

We have prepared a detailed special dossier on the topic “Acquisition of real estate property in Mauritius”, which we are happy to make available to interested parties free of charge.