Case Studies: How companies, entrepreneurs and investors use Mauritius for their business case

There are many examples of doing successful business in Mauritius. Following you can find case studies of the most relevant business situations (click on image to scroll down).

Case studies for companies and corporations

Case studies for entrepreneurs and business owners

Case studies for investors and traders

Case Study 1

German export-oriented company wants to save cost and increase efficiency by outsourcing business processes

Situation

High labor cost in Germany.

Lack of available staff with foreign languages as mother tongue, and knowledge and experience in IFRS accounting, respectively.

Challenge

Internal reorganization requires a new level of proficiency.

Existing accounting staff is experienced with HGB (German accounting system) only.

Goal

Strengthen the company’s balance sheet by reducing cost.

Bringing the company to the next level by building international staff with the relevant language and accounting skills.

Solution

Setup an operational company in Mauritius as a GBC.

Hire bilingual workforce (English and French) for staffing a global call center in Mauritius, as well as qualified accountants for bookkeeping and accounting processes for subsidiaries worldwide

Case Study 2

Technology company from a developing nation looking for funding by global investors

Situation

Successful software company wanting to launch Software as a Service (SaaS) as a new product for global customers.

Challenge

Potential investors from Silicon Valley do not directly invest into companies based in the particular country due to political risk or regulatory shortfalls.

Goal

Structure the company in a way that it is acceptable for potential investors.

Develop the IP further and keep it at a safe place outside of the unstable home jurisdiction.

Solution

Setup a holding company in Mauritius for global expansion.

Setup daughter companies in target countries with IPPAs in place.

Benefit from tax treaties.

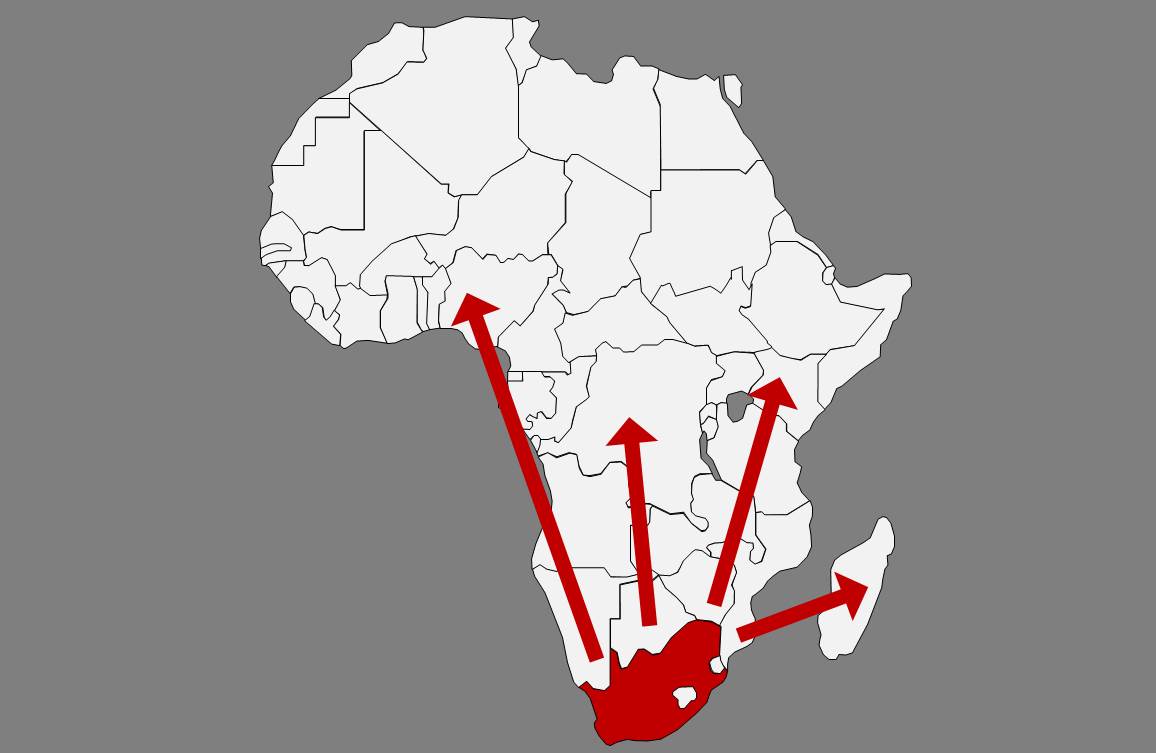

Case Study 3

South African company expanding its business to other African countries

Situation

White-owned business in SA with middle BBBEE scorecard values (BBBEE = Broad Based Black Economic Empowerment), wanting to expand business into Africa or globally.

Challenge

Has a BBBEE partner as shareholder that is not needed for conducting ex-SA businesses.

Therefore, the South African legal entity does not qualify for becoming a mother company for ex-SA business units.

Goal

Expand business outside of South Africa without having a BBBEE partner on board.

Keep revenue from African companies outside of South Africa where it can be reinvested.

Solution

Setup a Mauritius holding company where the company owner can have 100% ownership, ideally under a Mauritius family trust.

No limitations by foreign exchange controls in Mauritius.

Quick and hassle-free capital transfers without central bank involvement.

Case Study 4

European company using IP Box Schemes

Situation

The new IP Box Regime in Europe no longer allows the low taxation of income streams resulting from IP, as it was common in specific countries (i.e., Luxembourg, the Netherlands, Cyprus)

Challenge

Tax reduction of IP-related income becomes impossible after grandfathering ends in 2021

Goal

Find a new jurisdiction where IP-related income streams (i.e., royalties) can be cashed in with lower taxation

Solution

Found a GBC in Mauritius and transfer IP to it, or move existing company to Mauritius.

It must be noted, however, that GBCs holding IP Rights will be required to demonstrate that they have incurred expenditure in Mauritius which is proportionate to the R&D of the relevant IP Rights.

Case Study 5

Information entrepreneur who depends on the free expression of his opinion

Situation

In Germany, the right to freedom of expression has been effectively abolished. There is a hunt against everything middle-class, conservative, Christian, patriotic and liberal.

Contributions in social media that fall outside the corridor of opinion approved by politics and the media are deleted.

Challenge

The tightening of the Network Enforcement Act and other legislative projects in Germany lead to considerable risks for entrepreneurs who represent opinions contrary to the mainstream.

Goal

Liberation from the limitations of the increasing opinion dictatorship in Germany and other European countries.

Ensuring proper business operations including payment processing without state paternalism.

Solution

Production and dissemination of information from a location outside the EU, including domain and website hosting and storage of confidential data.

Setup a GBC in Mauritius.

Case Study 6

Digital Nomad looking for a tax residency

Situation

Successful online marketing business with low taxation, soon reaching a level of exceeding certain thresholds

Challenge

No permanent residency, leading to acute problems of opening bank accounts and potential problems with the tax authorities of the home country (subject-to-tax-clause).

Children have to go to school.

Goal

Establish a permanent residency in a country with territorial or remittance-based taxation system with having no CFC rules in force for individuals, permitting homeschooling, and requiring minimum physical attendance for obtaining tax residency.

Solution

Relocate to Mauritius and apply for a residence permit as a self-employed entrepreneur. Stay in Mauritius for >183 days in year 1 and year 2 each. From year 3, only 270 days in any three year period are required.

Register a GBC in Mauritius.

For non-Mauritian revenue (i.e. selling digital assets worldwide), eventually setup a separate company in a no-tax jurisdiction.

Case Study 7

Early retired pensioner looking for a new purpose

Situation

In most industrialized nations, there are many professionals that have received golden handshakes from their companies or have been sent into (too) early retirement.

They are still active and want to achieve something significant in life.

Challenge

Lack of opportunities in the developed world.

Most employers do not value higher age as a wealth of knowledge and experience but prefer younger managers.

Goal

Looking for a new challenge as an adviser, coach, incubator, business angel, co-founder or manager in a start-up in a developing nation, i.e. in Africa.

If necessary or advisable, relocate to a beautiful place with high living standards.

Solution

We have several interesting projects based on game-changing technologies or business models, welcoming experienced experts. In many cases, Mauritius will become the regional or global headquarters.

Talk to us!

Case Study 8

IT innovator / blockchain and other disruptive technologies

Situation

The entrepreneur has developed a promising business case based on a new technology.

He wants to go to market quickly.

Challenge

Due to the disruptive nature of the new technological paradigm, there is insufficient regulation representing legal threats and high economic risk for the entrepreneur.

Goal

Instead of waiting until the legal framework in his home jurisdiction would allow him the freedom to operate without major legal risks, he wants to setup the business in a more advanced jurisdiction.

Solution

The Mauritius Sandbox license is one of the best in the world, offering the entrepreneur the legal certainty and economic freedom that he is looking for.

Mauritius, being innovation-friendly, will become the blockchain hub for Africa => Mauritius offers a perfect environment for IT

Case Study 9

Asset protection for a wealthy individual from South Africa

Situation

All tangible and non-tangible assets are in South Africa.

Challenge

Unbalanced portfolio.

All eggs in one basket.

Exposure to political risk.

Goal

Wants to protect his family’s wealth from adverse conditions.

Wants to be prepared for moving out of SA should the need arise (Plan B).

Solution

Setup a family trust in Mauritius which will found an asset holding company in Mauritius.

Redirect foreign-sourced income into this SPV.

Transfer movable assets to the SPV, as well as gradually money from SA within the annual allowances for global investments.

Case Study 10

Asset manager from Germany wanting to launch his own investment fund

Situation

A German asset manager wants to launch his own investment fund and distribute it in the EU.

Challenge

Cost of setting up a mutual fund in Luxembourg (being the most flexible and “cheapest” financial center in the continental EU) would be $300-500,000 – too high for starting a new fund.

The regulatory framework for financial services providers is prohibitive for SMEs.

Also, there is an increasing lack of legal certainty.

Goal

Find an alternative solution at affordable cost in another jurisdiction with a conducive legal and financial environment.

(See cost comparison between Mauritius and Europe here.)

Solution

Setup a Collective Investment Scheme (CIS) or closed-end fund, and a CIS Management company in MU with a total setup cost of $30-50,000.

Establish a JV with a regulated financial intermediary player in the EU for getting access to the EU re marketing and distribution of financial products.

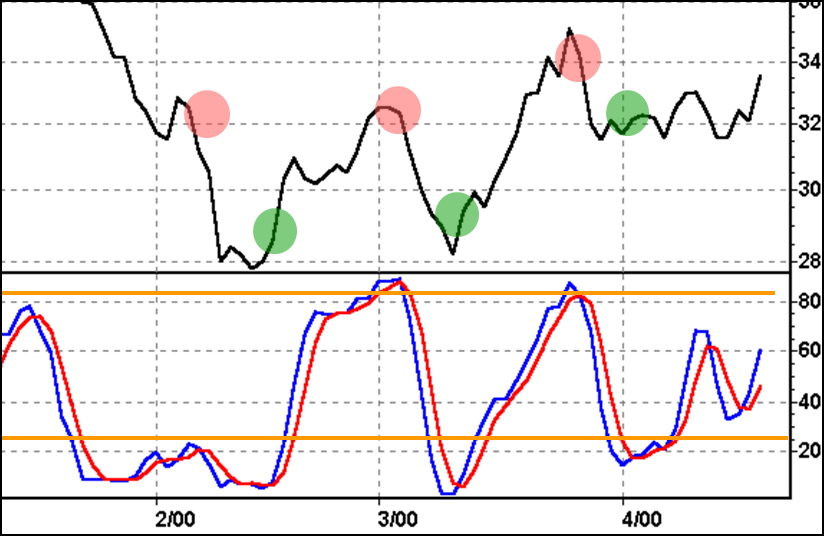

Case Study 11

Trader (full-time), wanting to escape from capital gains tax and excise tax

Situation

Trading in securities and real estate is subject to Capital Gains Tax in Germany. Additionally, commercial traders have to pay excise tax.

Licenses for financial services are extremely expensive. For example, an investment adviser in Germany has to set aside 250,000 EUR in an escrow account that must be unimpaired at all times.

Challenge

CGT as a major limiting factor to performance; according to a new law to be launched in Germany in 2019, even unrealized profits in mutual funds will be taxed.

Excise tax for professional traders.

High regulatory hurdles if you want to provide financial services to clients.

Goal

Escape from tax laws and regulatory requirements that are prohibitive for small financial traders.

Solution

Setup your own investment vehicle in Mauritius where is no CGT and no excise tax.

Enjoy excellent bandwidth and proximity to the landing point of new submarine fiber optic cable.

Better time zone for trading in Asian markets.

Case Study 12

Global investor wanting to diversify his portfolio

Situation

The investor holds a securities portfolio with a traditional asset allocation, with a heavy exposure to bonds and stocks in the US and Europe.

Challenge

The vulnerability of the world financial system includes a big threat to the portfolio.

A financial crash could lead to big losses in the portfolio.

Goal

Make the portfolio resilient by diversifying it towards alternative asset classes in developing markets and direct investments in non-financial sectors.

Solution

Setup a closed-end fund or a Protected Cell Company in Mauritius.

Direct investments, i.e. an office building in Mauritius, dirt cheap property in Zimbabwe, or participations in agricultural projects in Africa, shall be put into appropriate investment vehicles under the CEF or PCC.