Law

Mauritius Legal SystemThe laws of Mauritius are the result of a hybrid system combining more particularly British common law and the French Napoleonic Code, with the modern legislation in the fields of company, banking, finance and taxation having a very strong English flavor.

Laws and Legal Framework in Mauritius

Most important Acts

Compliance: Low Regulatory Burden in Mauritius

Major changes in law usually follow a predictable sequence of steps:

“Mauritius is characterized by strong business dynamism and sustained by lean administrative requirements that enable companies to open and close with relative ease.”

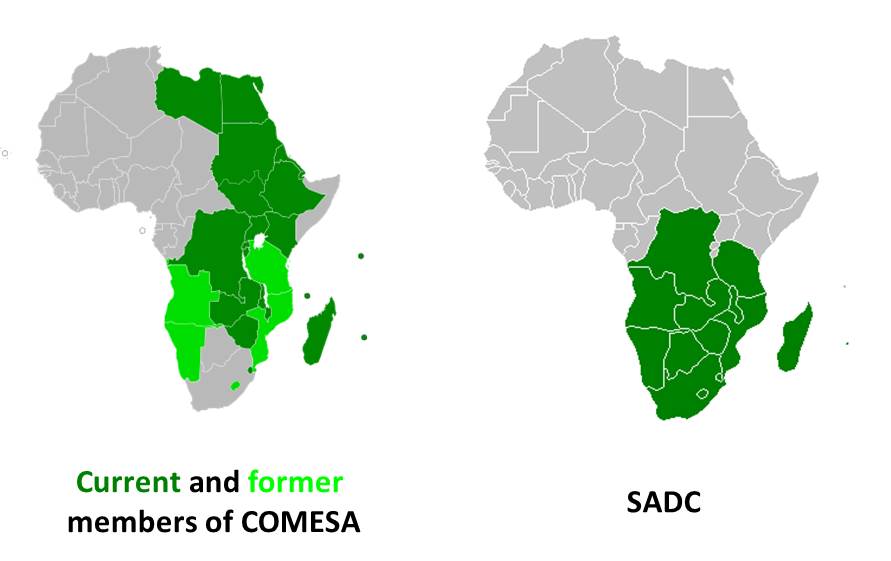

Regional Integration in Africa: COMESA, SADC & IORA

- Southern African Development Community (SADC)

- Common Market for Eastern and Southern Africa (COMESA)

- Indian Ocean Rim Association (IORA). (The Coordinating Secretariat of IORA is located at Ebene, Mauritius.)

Multi-lateral agreements of Mauritius

In Europe, the European Union (EU) not only issues new laws, regulations, orders and directives almost every week affecting their member countries, it also regulates transactions between entities of their member countries with entities in non-EU countries. A good example for that is the Regulation (EU) 2016/679 (General Data Protection Regulation). Mauritius has changed their laws accordingly in order to fully comply with the GDPR.

On the positive side, Mauritius is a signatory to the European Union Economic Partnership Agreement (EU-EPAs). Amongst other items of the agreement, there is elimination of duties/quotas for Mauritius imports into the EU, flexible rules of origin, dispute settlement mechanism and development cooperation provisions.

The Common Reporting Standard (CRS) is an information standard for the automatic exchange of information regarding bank accounts on a global level, between tax authorities, which the Organization for Economic Co-operation and Development (OECD) developed in 2014. Mauritius has started to report in 2018.

However, the OECD allows the participating countries to determine what accounts are reportable. To figure out which accounts of our clients in Mauritius are reportable is part of our consulting services.

The Global Forum on Transparency and Exchange of Information for Tax Purposes has rated Mauritius as an OECD Compliant jurisdiction on 21 August 2017.

Under the United States Africa Growth & Opportunities Act (AGOA) Mauritius, being part of Africa, has duty free access to the US markets for over 7,000 products including apparel, footwear, wine, motor vehicles components and agricultural products.

The Foreign Account Tax Compliance Act (FATCA) is a 2010 United States federal law requiring all non-U.S. (‘foreign’) financial institutions (FFIs) to search their records for customers with indicia of ‘U.S.-person’ status and to report the assets and identities of such persons to the U.S. Department of the Treasury.

We are working together with management companies and banks that are accepting U.S. persons as founders, shareholders, trustees, beneficiaries, and owners of corporate and private bank accounts.

Mauritius is a member of the Multilateral Investment Guarantee Agency (MIGA), a World Bank agency. MIGA provides non-commercial guarantees (insurance) for cross border investments in developing countries. The guarantees protect investors against the risks of expropriation, war and civil disturbance, capital transfer restrictions, breach of contract and non-honouring of sovereign financial obligations. Companies incorporated in Mauritius are eligible for MIGA guarantees.

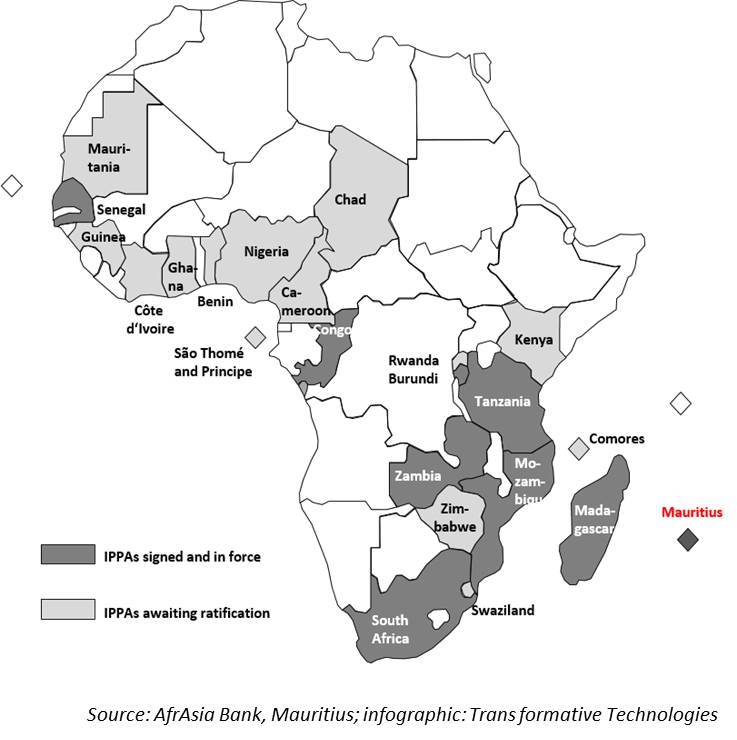

Investment Promotion and Protection Agreements (IPPAs)

IPPA typically offers the following guarantees to investors from the contracting states:

- Free repatriation of investment capital and returns;

- Guarantee against expropriation;

- Most favored nation rule with respect to the treatment of investment, compensation for losses in case of war or armed conflict or riot etc;

- Arrangement for settlement of disputes between investors and the contracting states.